2016 Section 179 Tax Breaks Extended

2016 Section 179 Tax Breaks Extended

Fast Facts about the Section 179 tax deduction:

- Tax code created to help businesses.

- Valid on most types of equipment.

- Can greatly help your bottom line.

- Simple to use.

- Enhancements typically expire at year’s end.

- There is simply no better time than now.

Essentially, Section 179 works like this:

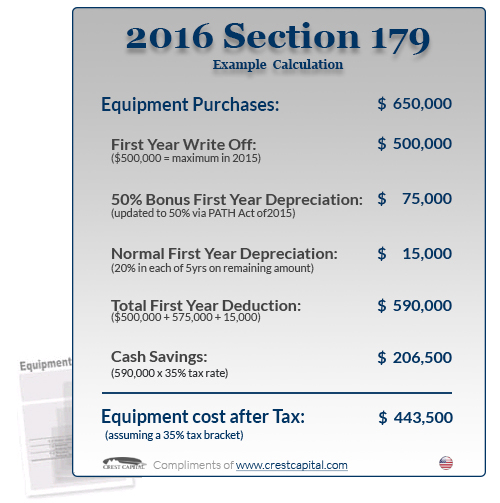

When your business buys certain items of equipment, it typically gets to write them off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it’s true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

In fact, if a business could write off the entire amount, they might add more equipment this year instead of waiting over the next few years. That’s the whole purpose behind Section 179 – to motivate the American economy (and your business) to move in a positive direction. For most small businesses, the entire cost can be written-off on the 2016 tax return (up to $500,000).

Contact Us to Learn!