Section 179 Tax Breaks Extended

Section 179 Tax Breaks Extended

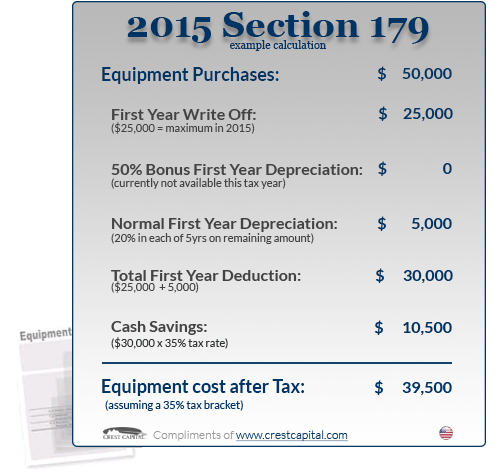

2014 section 179 tax deduction write offThis allows contractors to apply a 50 percent bonus depreciation to any equipment bought during a fiscal year. For example, 50 percent of any equipment bought before Dec. 31, 2015, can be depreciated on a company’s 2015 taxes, with the rest depreciated over the remaining useful life of the equipment. This section of the tax code, according to the section179.org website, allows businesses to deduct from its gross income the full purchase price of qualifying equipment bought during a tax year, instead of depreciating it over time.

Read entire article: http://www.equipmentworld.com/bonus-depreciation-section-179-tax-breaks-extended-sent-to-president-obama-for-signature/

What is the Section 179 Deduction?

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Learn more at: http://www.section179.org/section_179_deduction.html