Section 179 Tax Breaks Extended

Section 179 Tax Breaks Extended

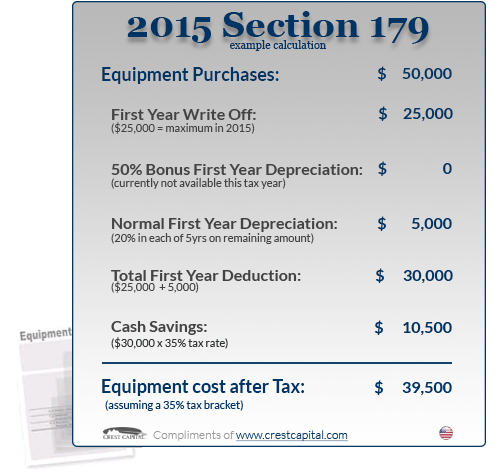

2014 section 179 tax deduction write offThis allows contractors to apply a 50 percent bonus depreciation to any equipment bought during a fiscal year. For example, 50 percent of any equipment bought before Dec. 31, 2015, can be depreciated on a company’s 2015 taxes, with the rest depreciated over the remaining useful life of the equipment. (more…)

Section 179 Deduction

$AVE BIG: $AVE NOW

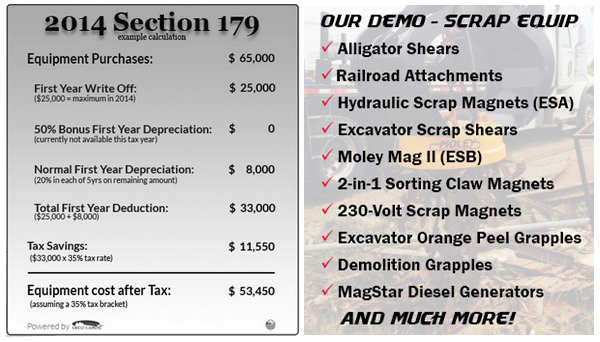

The U.S. Senate passed a $42 billion package of tax incentives, reviving dozens of lapsed breaks for 2014…

Only this 2014 tax year is covered by this measure – therefore it is a good business decision for many to finance equipment immediately to make the December 31, 2014 cutoff for the write-off provisions. Your business must apply for Section 179 Qualified Financing as soon as possible to make the cut-off at midnight 12/31/2014. (more…)