Section 179 Deduction

$AVE BIG: $AVE NOW

The U.S. Senate passed a $42 billion package of tax incentives, reviving dozens of lapsed breaks for 2014…

Only this 2014 tax year is covered by this measure – therefore it is a good business decision for many to finance equipment immediately to make the December 31, 2014 cutoff for the write-off provisions. Your business must apply for Section 179 Qualified Financing as soon as possible to make the cut-off at midnight 12/31/2014.

What is the Section 179 Deduction?

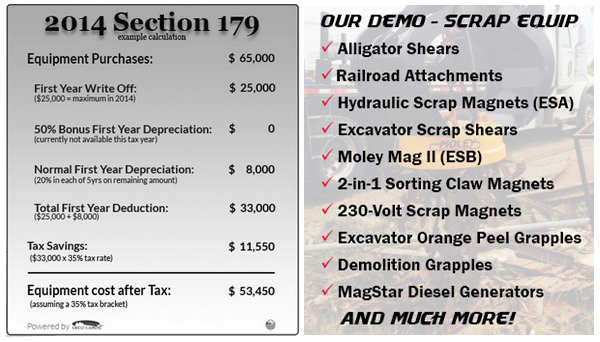

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Section 179 Deduction at a Glance:

2014 Deduction Limit = $500,000

This is good on new and used equipment, as well as off-the-shelf software. This limit is only good for 2014, and the equipment must be financed/purchased and put into service by the end of the day, 12/31/2014.

2014 Limit on equipment purchases = $2,000,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis.

Bonus Depreciation: 50%

This is taken after the $2million Section 179 cap is reached. Note: Bonus Depreciation is available for new equipment only.

How Much Can I Save on My Taxes in 2014?

It depends on the amount of qualifying equipment and software that you purchase and put into use. For more information on how you can SAVE, Contact us NOW. 1 (844) M-MAGNET (662-4638) | sales@moleyinc.com